reit dividend tax malaysia

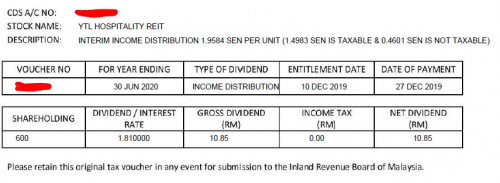

Date Financial Year Ex-Date Entitlement Date Payment Date Entitlement Type Dividend Cent Dividend Details. Management previously said distributable cash flow is expected to rise by 5-7 annually over the medium term supported by a steady annual capital program of 5-6 billion.

Finance Malaysia Blogspot Understanding Reits

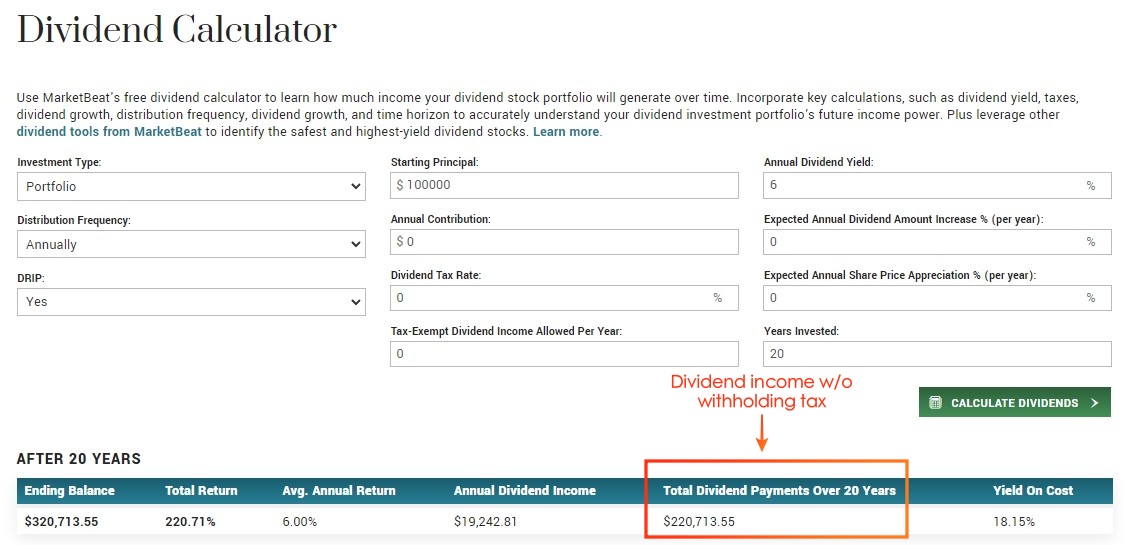

With a 10-year historical average of 597 I would prefer a higher yield of near 6 if I were to invest in the REIT.

. Try MST28 trading from Mercury Securities with rates as low as 005. The disposal of REIT units will have CGT implications. KRG announced today that its Board of Trustees declared a quarterly cash distribution of 022 per common share for.

Source-country tax on dividends will be generally limited to 15 subject to an exemption for dividends paid to certain pension funds or government investment funds beneficially holding less than 10 of the voting power in the company paying the dividend and a 5 limit that will apply to dividends paid to companies with voting power of 10 or. KUALA LUMPUR Aug 1. At the same time the maximum tax exemption per employee is RM3000year.

The group declared a second interim dividend of 25 sen per share. Net profit increased 97 to S198 million on revenue growth of 118 to S825 million in FY2022. Can you provide a link to download all ADRs from all countries that are traded on US stock exchanges.

Nikko Asset Management Asia Limited as Manager of the NikkoAM-Straitstrading Asia Ex Japan REIT ETF applied to be accorded tax transparency treatment status and was granted the. February is usually a high dividend month as most Malaysian REITs announce their Q4 dividends in late January with the following month as the ex-date. Areca capital declares income distribution for areca progressive income fund apif.

Assuming youre a sales manager who will travel to Australia to attend a trade conference. Areca capital declares income distribution for areca strategic income fund 30 astif3 15 august 2022. DollarDEX Investments is an online wealth management platform designed for everyone to invest.

Unitholders may be entitled to a foreign tax credit for foreign taxes paid by a REIT. British American Tobacco Malaysia Bhds BAT Malaysia net profit for the second quarter ended June 30 2022 increased by 23 to RM7325 million up from RM7162 million a year ago driven by marginally higher revenue and gross profit margin coupled with lower tax expenses. Now that Ive sold many of my individual REITs things may change a little moving forward.

So that I dont have to download all the lists myself and put them all together for a symbol list for my trading program. YTL Hospitality REITs net property income NPI for the fourth quarter ended June 30 2022 4QFY22 rose 373 to RM568 million from RM547 a year earlier due to improved performance from its hotel segmentQuarterly revenue increased 1905 to RM1064 million from RM894 million according to the REITs filing with the bourse on. In terms of valuation MIT currently trades at a dividend yield of 51 as of 1 August 2022.

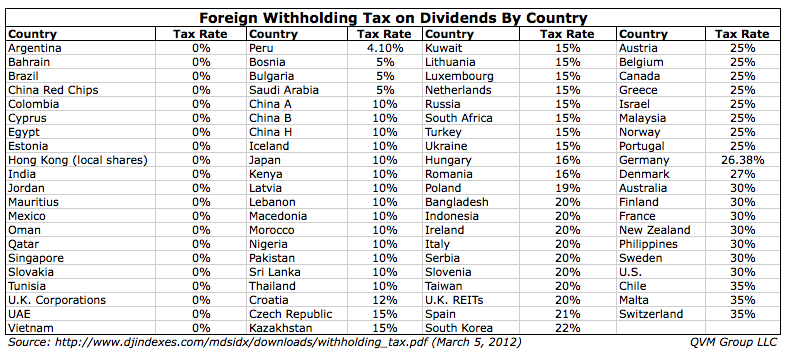

Zacks free daily newsletter Profit from the Pros provides 1 Rank Strong Buy stocks etfs and more to research for your financial portfolio. Malaysia - 25 Malta - 35 Mexico - 10 Moroccco - 10 The Netherlands - 15 New Zealand - 30. There is a limit to the amount of foreign tax credit received.

Get FREE real time quotes on our website App. Groups return-on-equity improves to a record 34 in FY2022. Meanwhile the group also declared a second interim dividend of five sen per share payable on Sept 30 2022.

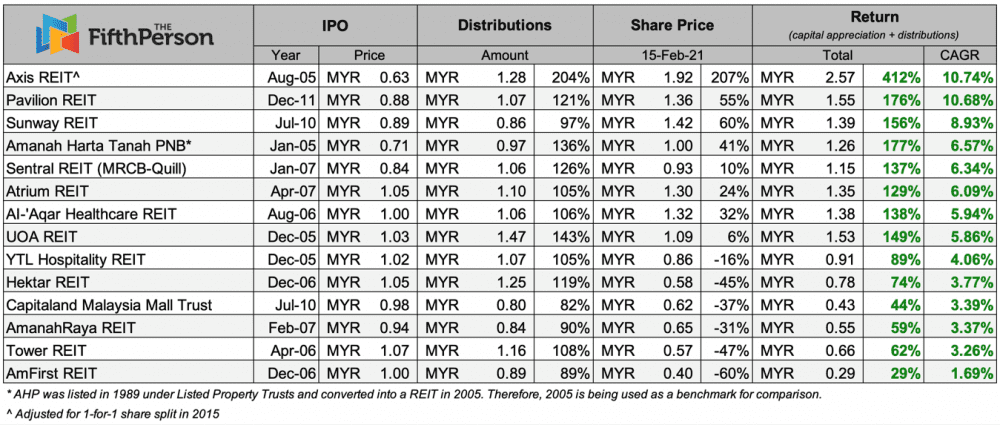

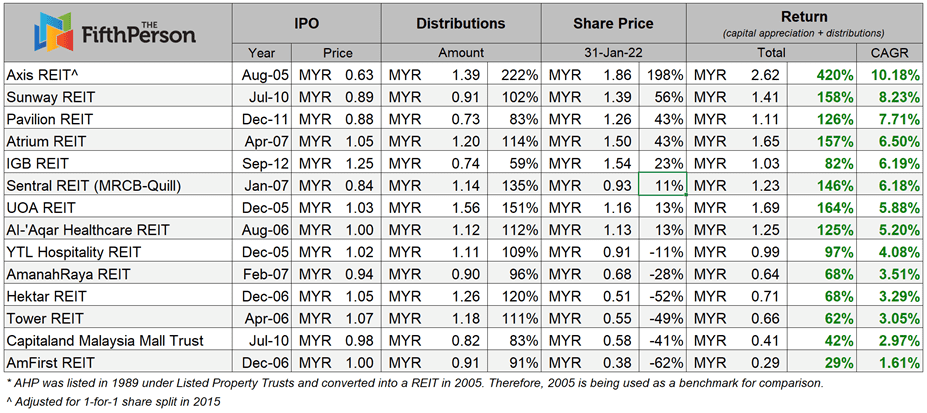

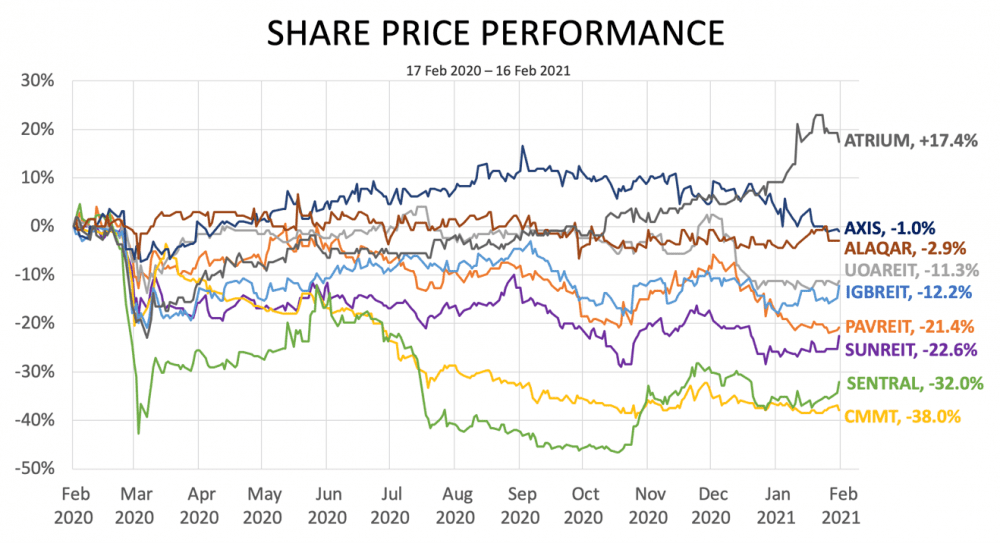

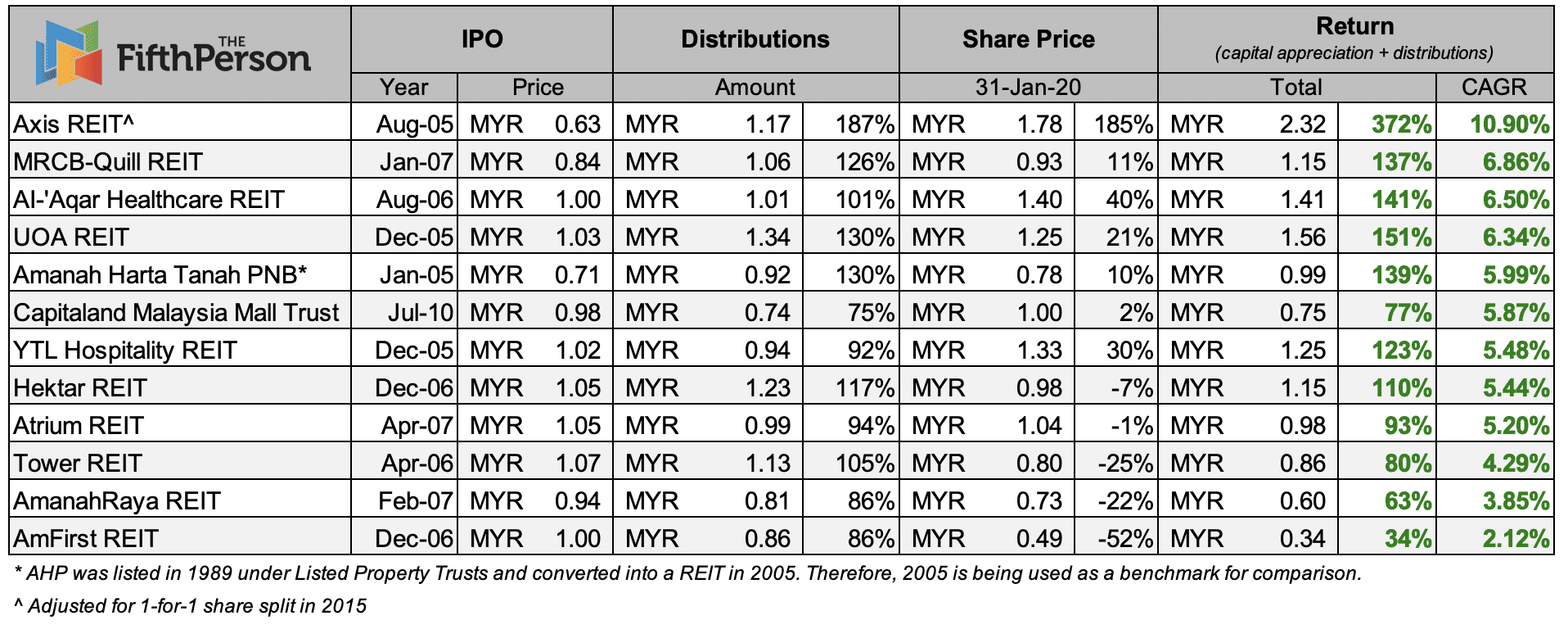

With Overseas Leave Passage the company will not be entitled to a tax deduction. For the first half of FY22 the groups net. 1074 Since 2005 every RM1000 investment in Axis REIT wouldve turned into RM2980.

As a subsidiary of Singapore Life Ltd we provide financial advisory licenced by MAS. Enbridge has raised the dividend in each of the past 27 years. Proposing final dividend of 6 cents per share and special dividend of 2 cents per share which will bring the total dividend payout to 14 cents per share for FY2022.

Areca capital declares income distribution for areca strategic income fund 40 astif4 03 august 2022. Including the dividends every RM1000 would cumulatively become RM2580. 10 2022 GLOBE NEWSWIRE -- Kite Realty Group Trust NYSE.

Investors can now pick up a 62 dividend yield and should see annual dividend growth of 3-5. On 9th July 2018 the Inland Revenue Authority of Singapore IRAS published the second edition of its e-Tax Guide detailing the income tax treatment of REIT ETFs. Sunway REIT Annualised return.

Earn MS Coin when you trade with MST28. The credit is applied against the Australian tax payable on foreign sourced income. Dividend Income February.

771 Since 2010 every RM1000 investment in SUNWAY REIT wouldve turned into RM1560. 23 august 2022. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate.

Most countries laws on REITs entitle a. The capital gain component of a REIT distribution must be included in the unitholders net capital gain calculation. Axis REIT Annualised return.

Overseas Leave Passage on the other hand is slightly different from local leave passage. Try MST28 trading from Mercury Securities with rates as low as 005. Liked our analysis of this AGM.

REIT MLP BDC Clean energy Uranium Lithium Precious metals Water.

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

The Complete Guide To Reits In Malaysia Your Real Estate Partner

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2022

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

How Reit Regimes Are Doing In 2018 Ey Slovakia

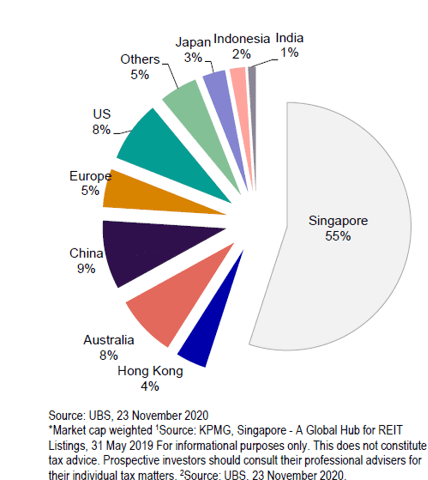

8 Things Every Investor Should Know About Asia Pacific Reits In 2021

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Investment Tips Strategies For Malaysians Dividend Magic

Top 5 Malaysian Reits That Made Money If You Invested From Their Ipos

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How To Invest In Malaysia Reits Best Guide For Beginner Ringgit Insider

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

5 Criteria I Use To Pick Outstanding Reit Marcus Keong

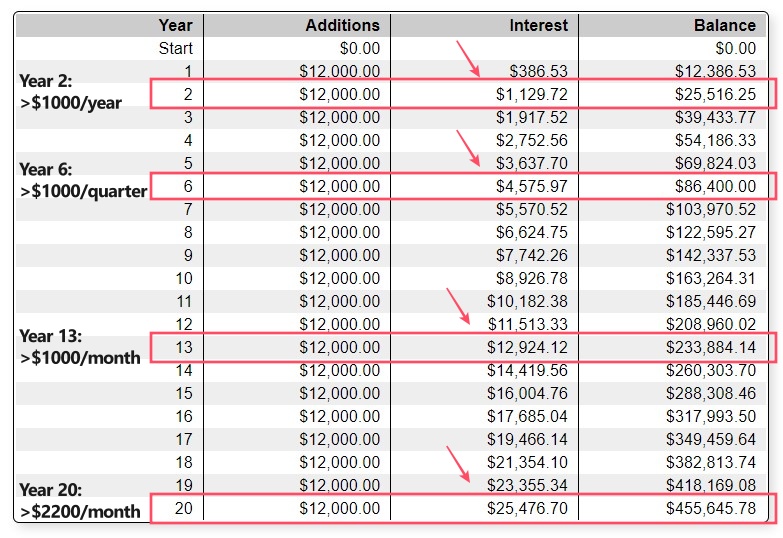

Sponsored Post Guide How To Make 1 000 Month Passive Income From Dividends Via Reit No Money Lah